BEWARE of charity vehicle donation programs that guarantee to deliver proceeds to any Group without having possessing a immediate marriage. All charities are certainly not designed equivalent, and all car or truck donation plans aren't operate Along with the same awareness to donor wishes.

We get most automobiles identical or upcoming day, then we handle The remainder. At the time marketed, we offer you a tax-deductible certification, and present you with everything you have to know on your most tax deduction.

In the event your auto sells for $five hundred or much less, you are able to deduct the “reasonable sector benefit” of one's automobile, up to $500. We endorse that you simply discuss with your tax advisor to determine your individual tax deduction condition.

We make it rapid and easy to donate a vehicle and chances are you'll qualify to get a tax deduction. Your car or truck donations elevated around $72 million in just the last five years!

Normally the Group will tackle the paperwork While using the DMV. Make sure you never hand around a signed title with no listing the transferee! Again, it is best to seek advice from with tax and legal professionals ahead of completing this process and never rely only on this details.

We are going to schedule and Arrange the pick up of your car or truck from wherever inside the continental Usa.

— Adrian “We donated our motor vehicle to KPCC simply because we hear KPCC all the time and planned to assistance point primarily based journalism that retains our community connected. We'd like that now more than ever.” - Tony U.

Data contained on EasyCarDonation.org is furnished as a place to begin and really should not be viewed as website legal or money guidance.

Charity Vehicles bases its selection on many elements like, although not limited to: calendar year, make, model, mileage, affliction, place, recipient, repair and funding restrictions. Considering the fact that putting a car or truck that has a client is the exception rather than the rule, donors should presume that their automobile will probably be sold at auction or for salvage With all the proceeds returning to our charity. We are going to notify the donor by cellphone and in creating if their motor vehicle qualifies as being a “software car” and may be furnished to a professional person or entity.

The acquiring charity is needed by IRS to deliver the donor a receipt or "contemporaneous penned acknowledgement" within just 30 times in the car sale. This receipt will have to incorporate the following:

* It's the Charity Autos mission to offer as a lot of good quality cars as is possible to deserving people. If you want to be one hundred% specific that your car will probably be here utilized as a “application auto” which entitles you to receive the most “Reasonable Marketplace Value” tax receipt, merely ask our donation consultant about our pre-approval course of action (1-800-242-7489 x two). While we recognize all automobile donations, in almost any problem, running or not, the overwhelming majority of donated automobiles do not qualify being “software motor vehicles” (offered to a qualified man or woman or entity).

Check out with your tax preparer to determine if You will be qualified or not. You can also talk to with them about any Added benefits check here when you file State taxes.

A press release stating what the charity presented in return with the donation: That no goods or solutions had been furnished.

Cars that don't qualify for being specified to your loved ones are marketed and help fund repairs to method vehicles. website This way, more info although your car would not run, you are supporting a family members receive a reliable, Performing vehicle.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Jennifer Love Hewitt Then & Now!

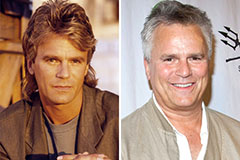

Jennifer Love Hewitt Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!